In a study of investment, revenue and profit data from Norwegian startup companies which expanded to the U.S., Next Step found that the Norwegian firms, on average, had far weaker revenue growth and limited or non-existent profitability as compared to similar U.S. startups.

In a study of investment, revenue and profit data from Norwegian startup companies which expanded to the U.S., Next Step found that the Norwegian firms, on average, had far weaker revenue growth and limited or non-existent profitability as compared to similar U.S. startups.

- This white paper presents the study’s findings and their implications, including:

- Success rate as measured by revenue, profitability and return on investment during initial three years after expansion.

- Differences between the Norwegian entrepreneurs and investors’ approach to funding and the U.S./Silicon Valley mindset.

- Factors contributing to three Norwegian companies’ success in their U.S. expansion.

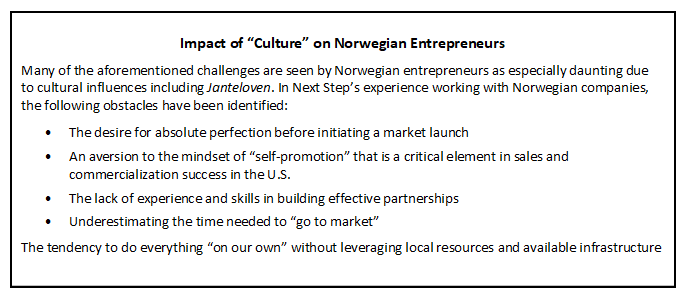

- Challenges (including cultural differences) that impact the success of Norwegian companies’ U.S. expansion.

- Specific recommendations for Norwegian entrepreneurs and investors to increase the success of their expansion/investment in the U.S.

The Opportunity

To many Nordic entrepreneurs, the prospect of growth in the United States is incredibly appealing. As a leading market for technology, life sciences, and environmentally-friendly solutions, the U.S. also serves as a gateway for global expansion into Asia and South America. Therefore, success in the U.S. marketplace is essential to achieve real impact and either sustainable business growth or a lucrative exit—for entrepreneurs and their investors.

What are the success rates for Norwegian companies in their U.S. expansions?

To better understand the success factors and potential traps associated with U.S. expansion, Next Step, a Silicon Valley-based consulting firm with a branch in Oslo, recently conducted a study of twenty Norwegian companies that launched sales and/or operations in the United States between 2007 and 2013. Using publicly available data, the study reviewed performance against financial, investment and business growth metrics for these companies in technology, life sciences, clean tech and consumer-related fields—with some general comparisons of their progress to typical U.S. companies.

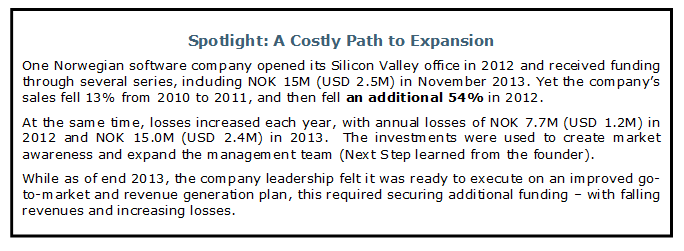

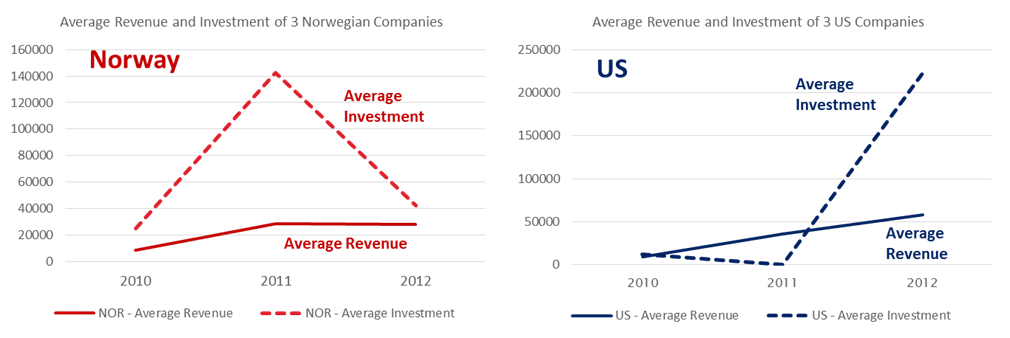

Next Step’s review of the Norwegian firms’ revenues and profits revealed an alarming pattern. During the first three years following U.S. expansion, the firms became, on average, increasingly unprofitable, despite continued new investment (Figure 1, below). Especially troubling for investors, only three of the twenty Norwegian companies achieved or came close to break-even during the three-year period.

Figure 1: Norwegian firms became increasingly unprofitable despite continued investment.

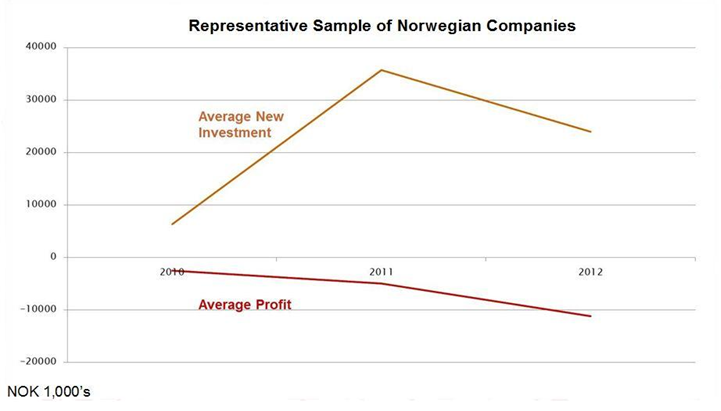

Many of the companies experienced increasing losses even as their revenues improved (see Figure 2 below). It is not known how the companies used their growing revenue, but public data indicated that there was neither significant investment in capital equipment nor a substantial increase in the number of U.S. and Norwegian employees.

Figure 2: Norwegian firms showed slow revenue growth and unprofitability following U.S. expansion.

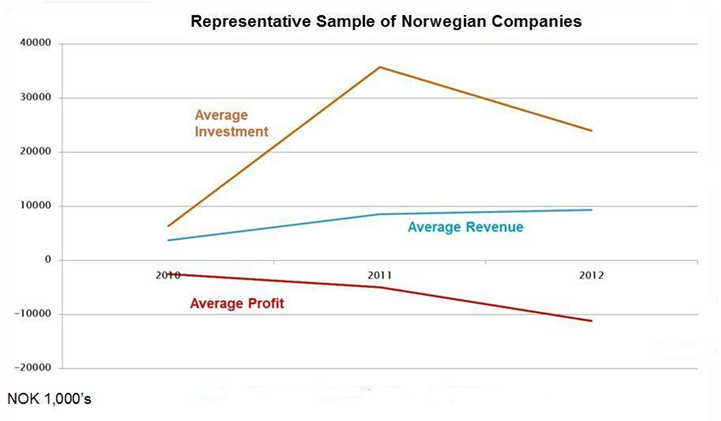

Unlike many U.S. investors, both the private (angel, seed, and venture capital) and public-sector investors in Norway demonstrated a high level of patience, loyalty, and confidence in the entrepreneurs, continuing to provide funding despite disappointing financial results and increasing losses (Fig. 3).

Figure 3: Investors continued funding Norwegian startups despite losses and weak revenues.

Indeed, all the companies in the study continued to receive funding during the three-year period—seemingly irrespective of financial results.

U.S. Investment Criteria

The practice of awarding significant additional funding to startups that have not achieved a strong track record of revenue growth and which are increasingly unprofitable is extremely uncommon in the U.S. investment community.

In Silicon Valley particularly, investors tend to fund cautiously based on the entrepreneurs’ plan for revenue generation as well as market traction and team strength. After the initial investment is utilized to support customer and revenue generation and the team has proven their ability to generate financial returns, then the investors “double down”—that is, provide increased funding—as a reward for early success. This practice reinforces growth and leads to a high rate of successful exits from startup phase.

Startup Success Quantified: A Guidepost for Norwegians

Norwegian entrepreneurs and investors have many motivations for their U.S. expansions: impacting lives on a global scale, creating more jobs for their countrymen, and expanding the awareness of their product or service are just a few.

Entrepreneurs seeking to attract additional funding from U.S. investors must operate at or above the standard level expected for a successful, venture-backed U.S. startup – namely, annual revenue of $1M or greater within the first year. Within two to three years following the investment, expectations are that the company will reach break-even and profitability, achieving at least 30 – 50% annual revenue growth rates.

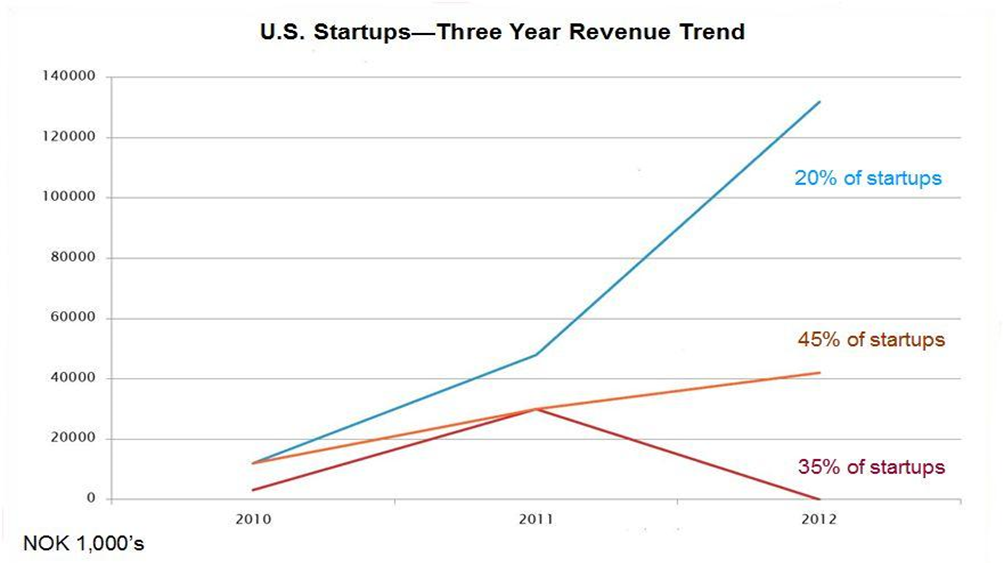

For U.S.-based startup companies which receive funding, Next Step estimates that approximately 20% will gain revenue traction; about 45% will see some revenue growth, but not enough to be considered true successes, and the remaining 35% may begin with positive revenue movement but will ultimately fail. These three patterns of revenue development are depicted in Figure 4.

Figure 4: U.S.-based startup companies typically follow three paths: significant revenue momentum, limited revenue growth, or sustained growth followed by failure.

Next Step’s study revealed a very different distribution of investment to revenue results for the Norwegian companies. These companies received funding early with the hope they would be successful, followed by continued but declining investment as they achieved a very flat revenue growth rate (Figure 5).

Figure 5: Norwegian startups with flat revenues received reduced funding, while U.S. startups with growing revenues received increased funding.

Scalability Becomes Issue for Norwegian Companies in U.S.

Less than 10% of Norwegian companies that initiate US market entry reach the ‘starting point’ of $1 million USD in revenue within 2 years. However, for those which are successful to this point often ‘hit a wall’ with stalled then declining revenue growth after reaching the first 1 – 3 million USD milestone.

Examples of these companies (also reviewed in Next Step’s study) include Questback and Moods of Norway. While these two companies penetrated very different markets (online business software service and consumer clothing), both (to different degrees) experienced strong initial market adoption and interest but lack of sustainable revenue growth to deliver profitability for the US operations.

Even Opera Software struggled in the initial years of its US operations as revenue growth failed to match the run-rate of expenses required for Silicon Valley operations (office, salaries, marketing, infrastructure). For Opera, the European/Nordic operation was able to continue to invest and ultimately through acquisitions in the US, build a successful and profitable US operation and presence.

From Next Step’s experience, some of the difficulties faced by all these companies during their first years in the US stemmed from:

- Limited understanding and success in developing customer relationships and market traction

- Little to no leverage of partners with knowledge, credibility, and traction in the US market (they do it alone syndrome)

- Location for US operation not best suited to build profitable US market presence

- Challenges with recruitment and development of the ‘right’ sales leadership and team

Fortunately, investors for Questback and Moods of Norway continue to be patiently supportive while, through acquisition Opera has shown profitability as well as sustainable in the US, which now contributes over 60% of the company’s annual revenue (2013) with over 200% profitability growth.

Norwegian Company Success is Possible

While challenging, there are opportunities for Norwegian company success in the US. Examples (in addition to Opera) include Laerdal Medical, which for 30 years has shown steady revenue growth and a healthy 13% rate of bottom line operating profitability. In the ICT market, Meltwater has delivered revenue and profitability returns through their growing US presence and subsidiary.

From Next Step’s experience, both of these companies have:

- Focused on full penetration within a clearly defined target market

- Utilized investment to build the market and US native team (versus location and Norwegian awareness)

- Recruited and developed local resources with networks and skills

Success is possible but it requires focus on sustainable growth of revenue, customer traction, and profitability to provide an ultimate return to investors.

Common Obstacles Associated with Expansion into the U.S. Market

The findings of this study and Next Step’s 18 years of experience working with 100s of Norwegian founders point to a number of obstacles they encounter toward achievement of the U.S. benchmark for startup success. These include:

- Underestimating the requirements for commercial success

- Not defining the most effective (specific) target market segment (as opposed to everyone) and location in the US

- Failure to fully leverage US natives/partners for market penetration

- Hiring the wrong people and/or using Norwegian expatriates as sales personnel

- Poor sales execution

- Naivety when initiating customer or partner relationships

- Waiting too long to commercialize and drive revenue

- Prioritizing funding and perfection of the product over customer acquisition and revenue generation

Many of these challenges can be overcome or avoided entirely through an understanding of the local market, recruitment of the right personnel, defining and understanding the ideal target market, and a strong focus on go-to-market/sales execution.

As demonstrated by Opera, Meltwater and Laerdal Medical, it is absolutely possible to navigate around limiting beliefs, cultural blind spots and erroneous assumptions in achieving successful expansion into the U.S.

Next Step to Maximize Results for Norwegian Entrepreneurs

Since 1997 Next Step has maximized success for Norwegian entrepreneurs (and their investors) through practical Go to Market / Commercialization services. Our team of 40 professionals across the US, Europe, and Norway works with Norwegian executives, boards and investors to build the US expansion plan, define the right market approach and location, establish the contacts, plan carefully, execute properly and avoid common pitfalls.

As we work with clients over the 12- to 18-months prior to and during penetration in the US market, we recommend that the entrepreneur and his / her team:

Spend significant time in the U.S. especially in the area in which the company’s target market most likely resides / purchases / does business.

- Refine your target market, validate your value proposition and finalize your go-to-market/commercialization plan

- Define the goals and structure (sales, operations, partnership) of your U.S. operation to meet the needs of your target market

- Leverage local resources and techniques for recruitment and/or engagement of sales, marketing and support team members

- Focus on customer acquisition and revenue generation to drive interest from investors (instead of seeking investment to fund customer acquisition)

- Be open to local (native) input and adaptable in your approach

Conclusion

The decision to expand sales and operations into the U.S. represents a tremendous opportunity to Norwegian entrepreneurs, but it can involve significant cost and risk. Whether the desired outcome is a profitable exit via acquisition, or sustained, double-digit revenue growth with increased profitability, the expansion must be carefully planned and executed to maximize opportunities and avoid common pitfalls.

By working with Next Step or other Norwegian / US experienced consultants who bring best practices, contacts, and methodology for successful U.S. expansion, the Norwegian entrepreneur, board member or investor can achieve a positive return on investment in the US market.

Study Methodology

Using data in the public domain, Next Step researched 20 Norwegian startups which received funding and launched sales or operations in the U.S. between 1997 and 2013. Nine of these companies were selected for detailed analysis and comparison against U.S. counterparts.

The results of the study were reviewed with the Norwegian Consul General in San Francisco; representatives from the Norwegian Ministry of Trade, Industry and Fisheries; venture capitalists; seed investors and incubator executives.