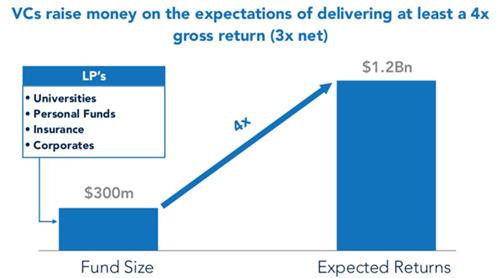

To many entrepreneurs, a key milestone on the path of success is attracting and securing venture funding. An even greater aspiration is funding from a US investor. However, if you really want to build a lasting, high-value company, venture capital might actually be damaging to your success. When you take VC cash, you are giving away ownership and often control of the direction and future of the business. Lean startup guru Steve Blank has summed this up well – “When you accept funding from a VC, their goals become yours – profitable exit in short period of time. In essence, the VC’s business model becomes your business model.” Therefore before seeking (and taking) VC funding, it is important to understand their standard business model… Let’s take an example – A VC with a fund size of $300M. Their goal, and in some cases requirement is to deliver 4x return to their investors, i.e. $1.2B.

Let’s say the VC invests $2M in your startup for 20% of your company (common terms in Silicon Valley). Based on successful growth, they invest an additional $8M over the next several years to maintain their ownership of 20% as profitability and/or valuation growths. After a few years, they’ve funded you to the tune of $10M. And let’s say you have an opportunity to sell. Exit for $800M. This may sound great to you while potentially being unacceptable or simply disappointing to your investor. That $10M investment by them is now worth $160M (20% of $800M). As the graph below indicates, that’s only half of their fund and only 13% of their needed return of $1.2B. So, while you feel the exit is a great opportunity for additional/future growth of your company or to allow you to move to your next venture, you may be required to continue to grow the company to meet the VCs higher requirements. Therefore, in retrospect, while the 10 million investment sounded great, it might not have been the best thing for your business and/or personal goals. It is for this reason that Next Step and many others in Silicon Valley counsel our entrepreneurial clients to consider their goals and options before seeking or taking Venture Capital.